At &us, we know that the mortgage process can feel painful for lenders and buyers alike. This is why we're highlighting organisations that offer innovative solutions to some of the biggest challenges across the home-buying journey. Check out the full list of innovators here, or read on to find out how Propflo is driving sustainability for home owners and businesses.

Tackling the climate crisis requires innovative solutions, particularly in the housing sector, where 20% of the UK’s carbon emissions originate. Luke Loveridge, the founder of Propflo, began his journey to simplify sustainability after realising how complex it was to make his own home greener. Leveraging experience from a prior sustainability venture, Propflo now offers tools to empower homeowners and businesses to adopt energy-efficient upgrades seamlessly.

How Propflo helps with the UK’s housing challenge

The UK’s housing stock is among the least energy-efficient in Europe, requiring over £250 billion of investment in the coming decades to meet energy standards. Luke explains, “It’s also really important for our energy security. We fundamentally want to help people easily make their homes greener.”

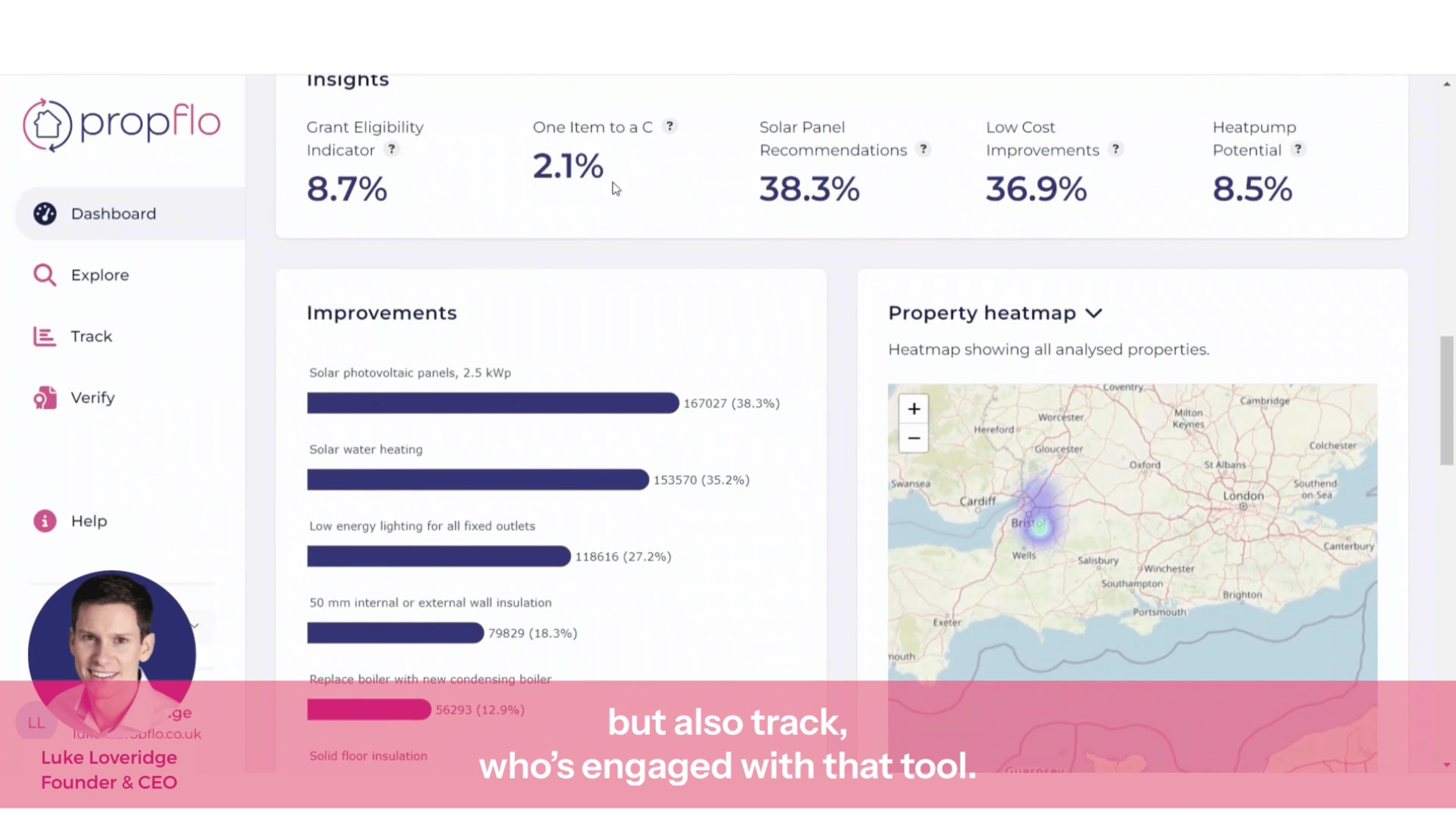

Propflo’s platform simplifies the journey to greener homes by providing businesses and homeowners with a range of innovative tools that bridge the gap between awareness and action. Specifically the platform includes three tools:

- GreenVal – A digital report enabling lenders and brokers to provide customers with insights into their property’s energy performance, recommended upgrades, and access to vetted suppliers for quotes.

- HomeHub – A tool for homeowners to manage improvement projects, monitor their impact, and stay engaged with their net-zero goals.

- PortfolioAudit – A resource for mortgage providers to analyse and track portfolio performance, identify grant-eligible properties, and engage the right customers effectively.

Making a measurable impact

Currently, Propflo supports 40–50 homes per month with green upgrades – a number that’s steadily growing. Trusted by major lenders like Hodge Bank and Molo Finance, Propflo is supporting over 1.5 million homeowners.

Luke explains the stakes for lenders: “90% of carbon emissions come from lenders’ back books, so they’ve got huge pressure to decarbonise.” Propflo’s platform helps businesses meet these challenges while engaging customers in meaningful ways.

AI and innovation at Propflo

AI underpins much of Propflo’s innovation. From advanced address-matching algorithms to predictive energy performance analysis, machine learning enhances accuracy and efficiency across the platform. Propflo is also exploring the use of generative AI to engage homeowners long-term, helping them optimise energy use and make informed upgrade decisions.

While AI offers immense potential, adoption in the property and finance sectors has its challenges:

- The pace of change – Rapid innovation could actually present a barrier in itself. “If something’s going to improve in the next six months, businesses might hold off and wait for the next iteration.”

- Education gaps – Many companies lack awareness of AI’s benefits or the skills to implement it effectively and still rely on spreadsheets.

- Risk aversion – The UK property and finance sectors are quite risk-averse, particularly when compared to the US. A solution is to ensure it’s possible to set up safe testing environments like sandboxes.

Luke advises organisations to take a problem-first approach: “It’s not about starting with AI and asking what problem we can solve, but identifying your problems and then exploring if AI can address them.”

Looking ahead to a greener property future

New regulatory demands, such as Labour’s proposed decarbonisation requirements for financial institutions, present opportunities for Propflo to engage businesses and their employees. Propflo plans to expand partnerships with lenders, brokers, and letting agents to grow its reach, particularly in the private landlord market.

Nonetheless, Luke emphasises that sustainability isn’t just about compliance – it’s a growth opportunity. “Our platform is designed to incentivise brokers, estate agents, and their customers to make these upgrades so they can benefit. It’s not just a PR piece – it’s a revenue growth opportunity.”

Propflo reflects how technology and innovation can transform the housing sector and make sustainability simpler and more achievable for all. By helping businesses and homeowners take action, the platform is working toward Net Zero goals and building a greener future for the UK.

Looking to explore AI and other options to improve your mortgage experience?

Whether you have an idea you want to explore, or you’re not sure where to start, the Greenhouse can help.

Where Ideas Grow.

If you want to get your own innovation cycle moving, take a look at the &us Greenhouse – a cost effective 2-4 week innovation programme designed to help you make progress faster.

More on mortgages

Untapped mortgage innovation opportunities for lenders

There are so many opportunities to improve the mortgage experience. See our ideas for how to get started, including how you can use AI to streamline processes and build stronger customer relationships.

10 mortgage innovators to add to your watch list

The mortgage industry is at a turning point and these innovators are leading the way. See how organisations are leveraging automation, AI and UX design to improve the mortgage journey.

%201-min.png?width=1000&height=500&name=Blog-Header-%20Mortgage%20POV%20-%202000x1000%20(1)%201-min.png)

Improving the mortgage experience for the next generation

Millennial and Gen Z buyer behaviours are leading to increased mortgage innovation and competition for lenders. Find out how you should be adapting and what opportunities are emerging.